Your bequest to support our mission should be planned thoughtfully. Many good planning techniques are available for giving from wills or revocable living trusts, and you should choose the type of bequest that best suits your personal objectives.

For example, your bequest can be a stated dollar amount, or you can bequeath specific property to Friends Committee on National Legislation. Some of our friends prefer to bequeath a certain percentage of the remainder of their estate — the amount that remains after paying all debts, costs, and other prior legacies. (You can visit our Sample Gift Language to get you started.)

Whichever form you prefer, you can direct that your bequest be used for our greatest needs or for a specific purpose you designate. Whatever your objectives, we will be happy to work with you in planning a bequest that will be satisfying, economical, and effective in carrying out your wishes in our important mission.

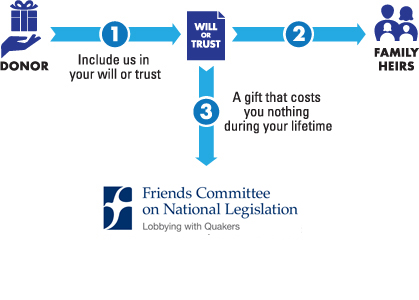

How It Works

- Include a gift to Friends Committee on National Legislation in your will or trust. (Here is sample language for your will.)

- Make your bequest unrestricted or direct it to a specific purpose.

- Indicate a specific amount or a percentage of the balance remaining in your estate or trust.

Benefits

- Your assets remain in your control during your lifetime.

- You can modify your gift to address changing circumstances.

- You can direct your gift to a particular purpose (be sure to check with us to make sure your gift can be used as intended).

Is this gift right for you?

A gift from your will or trust is for you if:

- You want to help ensure Friends Committee on National Legislation’s future viability and strength.

- Long-term planning is more important to you than an immediate income tax deduction.

- You want the flexibility of a gift commitment that doesn’t affect your current cash flow.

The material presented on this Planned Giving website is not offered as legal or tax advice. Read full disclaimer.